News Summary

Winners and losers and what it means for the State of Ohio

|

| Polic Matters Ohio (click on image to enlarge) |

(NEW) ABORTION RESTRICTIONS

- Requirement for abortion clinics to have patient-transfer agreements with private hospitals within 30 miles of them.

- Allow bars during certain major events, like the Republican National Convention in Cleveland, to stay open until 4 a.m.

- Prohibit a university from requiring a student to live on campus if the student lives within 25 miles of campus.

- Add $20 million per year to pay for state student assessments.

- Give charter e-schools $25 per pupil for facilities.

- Spends $955 million more in basic state aid for K-12 schools than the last two-year period.

- Boosts state funding for higher education to help offset a two-year tuition freeze at public universities.

- Requires colleges to propose ways to reduce student costs by 5 percent.

- Maintains the dollar amounts for the three categories of limited English proficient students from FY15 for both years of the biennium.

CHARTER SCHOOLS

- Facilities funding for brick and mortar community schools increased to $150 per-pupil, an increase of $50 over current law

- First time funding for facilities for E-schools of $25 per-pupil, to help with testing sites and counseling

- Community School Classroom Facilities Grant program with a $25M fund, can be accessed by "high-performing" schools

- Performance bonus payments for community schools and STEM schools linked to four-year graduation rates and performance bonus payments for community schools reaching targets for third grade reading proficiency scores

- Education Cut - Summary Analysis - Rich Exner, Northeast Ohio Media Group

Estimated $32.9 million in 2016-17, representing a third of veto-related cuts in education spending for the entire state...next largest amounts by county are $9.7 million for Hamilton County, $6.8 million for Summit County, $6.4 million for Franklin County and $4.7 million for Lake County.

By district, the largest losses because of the vetoes are $13.8 million in Cleveland, $3.6 million in Mason, $3.1 million for Lakota, $2.8 million for Strongsville, $2.7 million for Olentangy, and $2.6 million each for Mayfield and Mentor.

For overall state funding, the five largest losses from 2014-15 to 2016-17 on a percentage basis all involve Cuyahoga County districts: Independence (41.7 percent), Mayfield (40.5 percent), Orange (37.9 percent), Beachwood (35.9 percent) and Westlake (31.3 percent).

REF: Gov. John Kasich's vetoes cut $33 million from Cuyahoga County school districts;

find details for each Ohio district (database)

Rich Exner, Northeast Ohio Media Group By Rich Exner, Northeast Ohio Media Group, 7/2/2015

FIREWORKS

- Eliminates a requirement that consumers complete a form agreeing to take fireworks outside Ohio within 48 hours after buying them, though people still would be banned from setting them off in the state.

- Extend for two years a ban on new fireworks manufacturers in the state

- Require the state Lottery Commission to install 3,000 new gambling terminals into locations with liquor permits.

GOVERNMENT

GUNS- Increase the maximum allowable rainy-day fund from 5 percent of general revenue funds to 8.5 percent, or about $3.1 billion. Actual balance under the budget is about $2 billion, after the committee added another $50 million.

- Grant 5-percent annual pay raises for judges, and for county and township elected officials, their first pay increases since 2008.

- Terminate the Constitutional Modernization Commission on Jan. 1, 2018, three years earlier than its termination date when the commission was initially created.

- Requires a commission studying tax policy to recommend how to transition Ohio’s personal income tax to a 3.5 or 3.75 percent flat tax by tax year 2018 and to review a proposed tax increase on oil and gas drillers.

- The Budget Passed 62-33 by the House; and 23-9 by the Senate.

One Ohio House and one Ohio Senate Democrat voted for the final budget plan: Martin Sweeney, Cleveland (House Dist 14); Sandra Williams, Cuyahoga (Senate Dist 21).

- Eliminate journalists’ access to concealed handgun records.

- Prohibits independent health care and child care workers under contract with the state from unionizing.

- Invests $286 million over two years in to support work opportunities, increase home- and community-based services and provide new options for the developmentally disabled.

- Reduce state funding for cities that continue to collect traffic-camera revenue.

- Add $5 million to help cover costs of increased police training.

- "What we've achieved here we should be able to crow about from the roof of this Capitol and across our great state,"

- Gov. John Kasich - “Our goal of cutting taxes for hardworking Ohioans, ensuring funding for schools and supporting important initiatives that help various projects in the state has been.

- Ohio House Speaker Cliff Rosenberger - “This budget hurts our local communities and makes it harder for our hard-working middle-class families to get ahead. We expect our state budget to strengthen families while rewarding hard work to grow our economy in the long run. This budget falls short and it leaves workers behind,”

- State Rep. Nickie J. Antonio (D-Lakewood)

- increases the sales tax by a quarter percentage point

- 35-cent increase on a pack of cigarettes, to $1.60 per pack

- Allow phone companies to abandon landlines.

- sales-tax exemption for aerospace research.

- expansions of the new markets and historic rehabilitation tax credits, and a gold coin sales-tax exemption.

- an attempt to collect internet sales tax on transactions between out-of-state retailers and Ohioans.

- creation of new lottery games - self service terminals for bars and restaurants.

- property-tax break for owners of power plants.

- restriction on municipalities’ ability to use buffer zones around waterways.

- language that would of blocked moving forward with Medicaid expansion.

- budget item that would have imposed expensive private appraisal standards on county auditors' offices; current law allows "mass appraisal" techniques every six years.

- Special tax break to private water corporations that would have significantly reduced taxes on new tangible personal property.

Budget Info and Media

- House Bill 64 - Main Operating Budget FY2016-FY2017

- Kasich Veto Message, 6/30/2015

- Gov. John Kasich's vetoes cut $33 million from Cuyahoga County school districts;

find details for each Ohio district (database)

Rich Exner, Northeast Ohio Media Group By Rich Exner, Northeast Ohio Media Group, 7/2/2015 - Here’s why the state budget is a bad deal for most Ohioans

by Policy Matters Ohio, Zach Schiller and Wendy Patton, 7/1/2015 - How Gov. John Kasich's budget deal -- and his 44 vetoes -- will play on the 2016 campaign trailBy Henry J. Gomez, Northeast Ohio Media Group, 7/1/2015

- Arts on Line Education Update for July 2, 2015

Ohio Alliance for Arts Education - Legislative Update: Gov. Kasich signs Budget Bill, Retains Provisions for Charter Schools

Ohio Alliance for Public Charter Schools, 7/1/2015 - Kasich signs $71B budget after vetoing 44 items

Julie Carr Smyth, Associated Press, July 1, 2015 - Ohio budget: Gov. John Kasich vetoes 44 items in budget package

Associated Press, 7/1/2015 - Highlights of $71B Ohio budget before Gov. John Kasich

Associated Press, 6/30/2015 - John Kasich strikes 44 items with line-item veto, signs $130.3-billion state budget

Robert Higgs, Northeast Ohio Media Group Columbus bureau chief, 6/30/2015 - Conferees reach deal on Ohio budget

By Jim Siegel, The Columbus Dispatch, Thursday June 25, 2015 - Our latest e-news: The Ohio budget and more

Policy Matters Ohio, 5/12/2015

More of the same, what Policy Matters warned in January

SEE: A budget that works, 2016-17

Policy Matters Ohio, 1/29/2015

Selected Excerpts, read the full article at the link above.

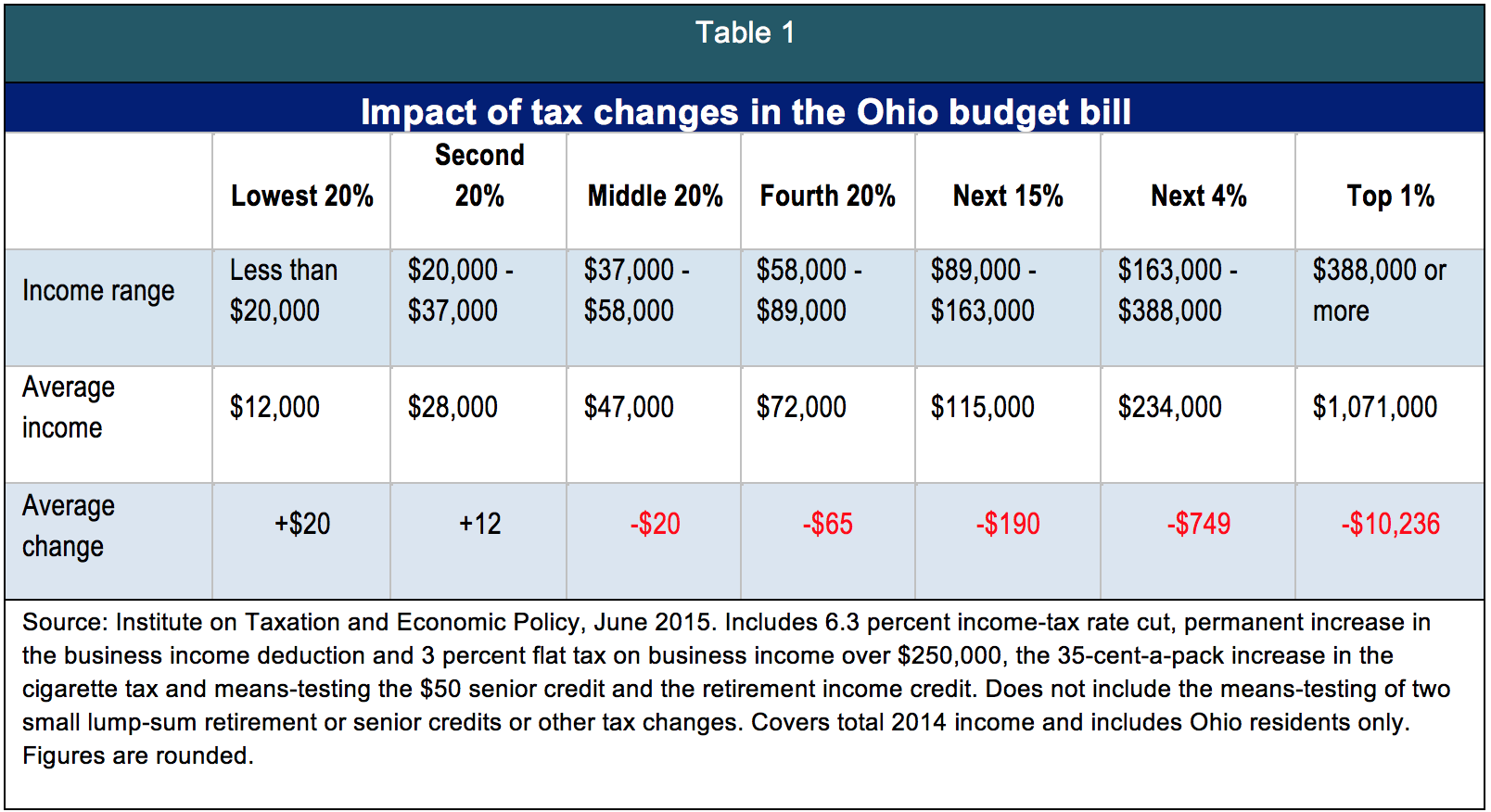

What the tax cuts have done has been to make our state and local tax structure less fair. After a decade of cuts to the personal income tax, the lowest 20 percent of tax filers, earning less than $18,000 per year, on average, pay 11.7 percent of their income in state and local taxes. The top 1 percent, earning more than $356,000, pay 7 percent on average (5.5 percent if the federal deduction of state and local taxes is taken into account).[19] On average, the wealthiest 1 percent have gotten a state tax cut of $20,000 a year since 2005, while the poorest pay $138 a year more and those in the middle pay $65 a year more.

- Employment growth lags the nation: The nation has more jobs now than before the recession, but Ohio has still not caught up to pre-recession employment levels. Nor have more recent job gains matched the national average.

- Poverty has stayed at high levels: The share of Ohioans living at the federal poverty level grew slightly from 15.8 percent in 2010 to 16 percent in 2013.

- Business creation: Ohio ranks 48th among the states in business creation per 1,000 workers.

- Low-wage jobs in the economy: Eleven out of the top twelve largest occupational categories in Ohio pay so little at the median they leave a parent with two kids in or close to poverty.

- Small business ownership: We rank 37th in small business ownership rate.

- Job creation: Ohio’s job growth (weighted by state population) ranked 32nd among the states and District of Columbia in 2014,[17] down from 22nd in 2011.

[Tax Cuts] Lawmakers have cut taxes nearly every year since 2005, costing the state about $3 billion a year…These cuts went mostly to businesses, which no longer pay a tax on corporate profits, and affluent individuals, who got most of income tax rate cuts of nearly 29 percent since 2005.

The estate tax was eliminated in 2013…Other new tax breaks, such as a new tax deduction for business income, are reducing revenue, while new taxes on casinos and racinos have not made up the difference in overall lost revenues during the past four years.

The state got money for tax cuts and spending in the last two budgets by taking funds from cities, other local governments and schools…down by $418 million a year compared to 2010. Adjusted for inflation to 2013 dollars, the loss is $813 million

Tax reimbursements for local health and human services alone dropped by $210 million over the level of funding in the prior budget, for FY 2010-11.

In the same period, tax reimbursements for schools dropped by $1.2 billion (not adjusted for inflation).

Libraries, which saw their funds slashed in the state budget for FYs 2010-11, were trimmed further. The state General Revenue Fund was $1.55 billion higher in both FY13 and FY14 because of these revenue diversions.

Ohio’s cash assistance program, Ohio Works First, has been cut almost in half since January of 2011. The number of people receiving assistance was reduced by nearly 116,000 as of December 2014.

Public transit: Ohio’s public transit system is severely underfunded. Routinely, less than 1 percent of the state’s transportation dollars go towards public transit, earning Ohio the rank of 47th in the nation for its commitment to public transit. In 2014, the state of Ohio spent just $27.3 million of the state’s $3 billion transportation budget on public transit.

[Public Trasportation] Due to persistent underfunding of Ohio’s public transit system over decades, The Ohio Department of Transportation’s (ODOT) statewide Transit Needs Study found an additional $563 million is needed in 2015—$273.5 million is needed just to address system backlog and bring Ohio’s transit fleet to a state of good repair; $289.1 million is needed to expand transit service to meet current, unmet demand ($192.4 million for vehicles and infrastructure, $96.7 million for operating costs).

Ohio: A state with average taxes

Ohio is sometimes wrongly portrayed as a high-tax state. Altogether, state and local taxes per capita in Ohio amounted to $4,053 in Fiscal Year 2012, less than the national average of $4,423. Such taxes amounted to 10.3 percent of personal income, the same as the national average.[126] Tax levels are fairly similar across most states.

See full report for Summary and recommendations.

No comments:

Post a Comment

Please feel free to leave your comment(s) or question(s).