The football stadium is financed by the taxes you mentioned

- sin tax, 8% parking tax, $2 on every vehicle rental plus an additional 2

percent on the admission tax.

We've paid much too much for sports in this town.

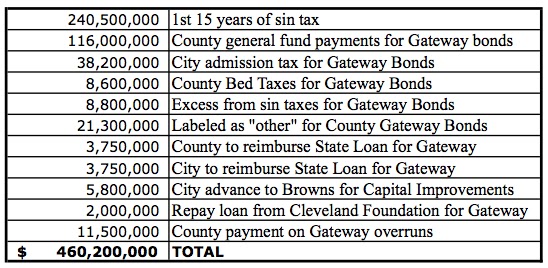

Here are some figures from the county that were compiled for

me and give somewhat of a real picture of the costs, though not all, since the

city is losing huge amounts on garages, having given the teams so many free

parking spots, and huge amounts on forgiven property taxes.

Here is that list:

Here are some figures of the tax outlay for Gateway and the

Browns stadium. Not mine. Most 2012 from the current County Auditor's

department:

Yeah, that much.

Total Cost thus far: $460.2 Million. This is the most

comprehensive accounting of the public cost of Cleveland's sports venues anyone

has produced.

(I wonder if the IRS ever thinks of totting all this free

stuff for income tax purposes. They seem ready to do it for Jimmy Dimora.)

Let's stop this madness.

It's not over. Some payments continue to 2023. So it will be

more than $460 million. (Note: Much more).

The tab is even still higher. We could add $37 million from

State of Ohio; $3 million RTA; $2.24 million Cleveland Sewer Dept.; $1/2

million City Water Dept. That's just for Browns stadium.

I don't have current figures for what Clevelanders are

paying on bonds for the football stadium. However, by May 2009 the city had

paid $102,823,947 and still owed $160,367,109 for bonds. Payments extend to

2027.

In addition to the sin tax money, the city - to pay for

Browns stadium - added an 8 percent tax on all parking in the city; raised the

admission tax on all events by 2 per cent; and added a $2 a car rental fee. All

dedicated to pay Lerner's bills. (A full discussion of the Browns funding is

here: How Good it Gets for the Lerner Family).

Best and thanks for your work Brian,

Roldo Bartimole

Roldo Bartimole has been reporting since 1959. He came to Cleveland in 1965 to report for the Plain Dealer where he worked twice in the 1960s, left for the Wall Street Journal in 1967. He started publishing his newsletter Point of View in 1968 and ended it in 2000.

In 1991 he was awarded the Second Annual Joe Callaway Award for Civic Courage in Washington, D.C. He received the Distinguished Service Award of the Society of Professional Journalists, Cleveland chapter, in 2002, and was named to the Cleveland Journalism Hall of Fame, 2004.

[Photo by Todd Bartimole.]

[Photo by Todd Bartimole.]